In every economy there are always events that can have a large financial impact on businesses and regions alike. Whether it’s a global pandemic or running inflation, these world events can affect prices, supply chains and demand. During these challenging times it is difficult to use the effects of those events to predict the future, that’s where AI can help but needs to be flexible and adjustable.

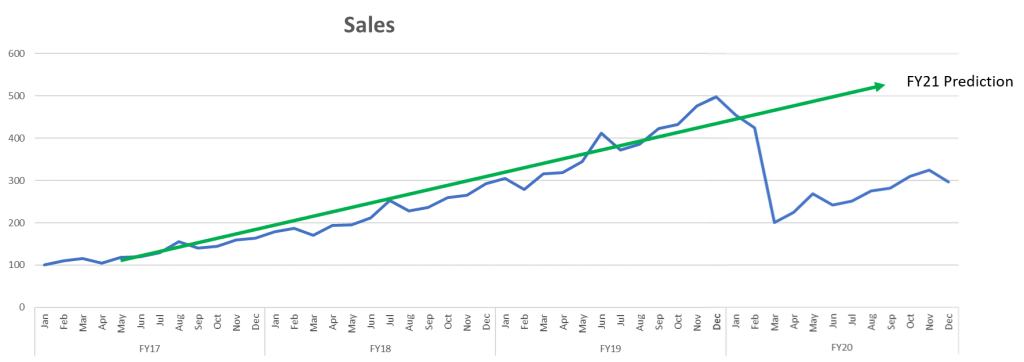

Post COVID, as organizations looked out on their forecast for 2021, using traditional run rates and historical averages does not make sense. The dip from 2020 often skews every chart and throws off any historical prediction tool’s data. The figure below shows where many organizations were predicting their business for 2021. When the impact from COVID hit in March 2020 most businesses saw a significant dip in earnings making their previous predictions irrelevant.

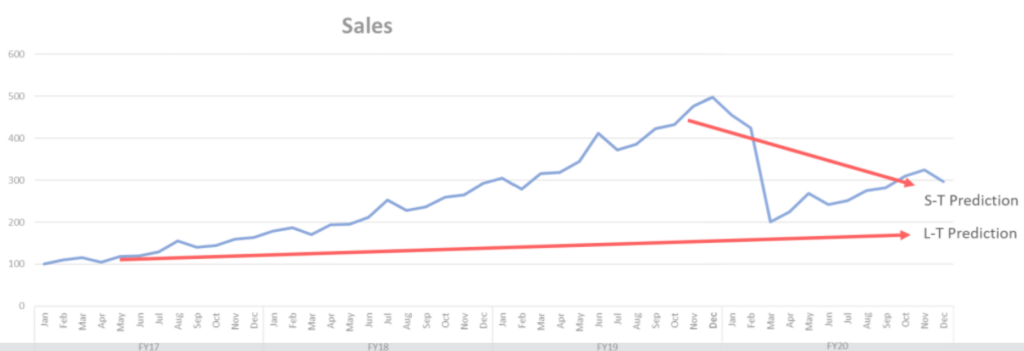

When accounting for these global events in the numbers with a three-year historical trend the Long-Term prediction can show a very flat or limited growth forecast. When a rolling 12-month historical trend as a Short-Term prediction the forecast might even produce negative growth.

Neither of the predictions above are accurate from what we see post-COVID. Growth rates are beginning to normalize at a deliberate pace. So how should organizations forecast their business given these recent trends? Here are a few approaches to consider.

Shorter Prediction Time Frames

Historically, run rates and prediction methodologies have used anywhere from 2-5 years of data to determine growth rates and forecasts. Predictions are usually more accurate when there is good history to predict from. Most methods can account for and normalize any slight variations or anomalies in the business. COVID’s impact was much bigger than expected in some cases, cutting projections in half of what was anticipated.

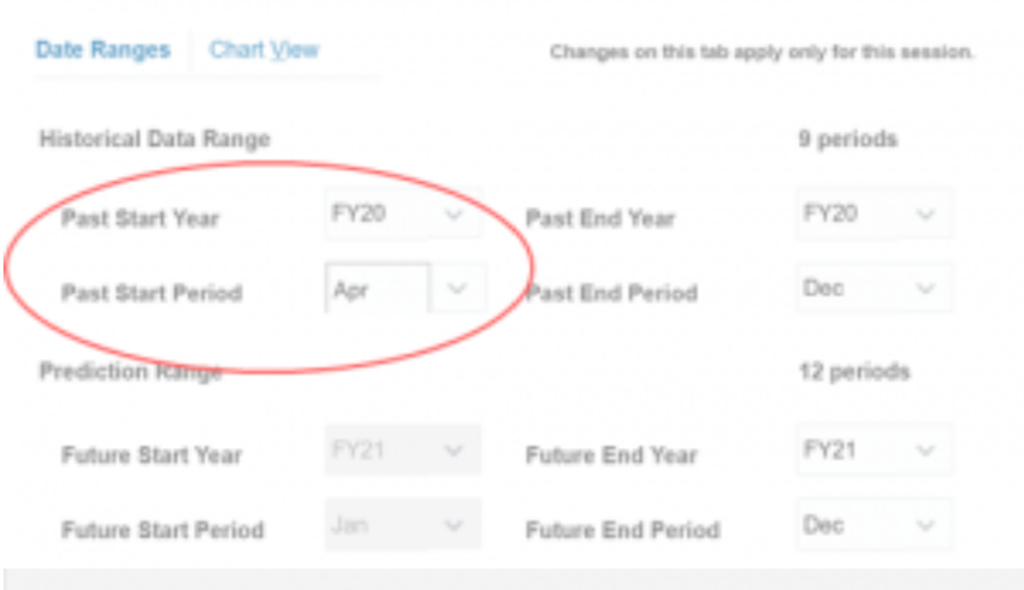

In order to resolve this drastic dip consider resetting the starting point of growth. Instead of any multi-year model, consider a short-term model that looks at the last 6 to 9 months of activity. Start at a point where the business begins to normalize again to avoid any hyper growth coming out of these events.

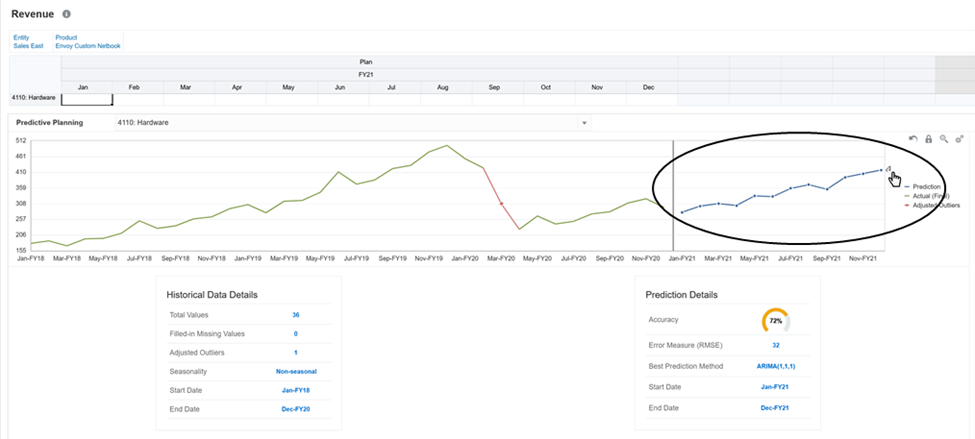

Below are examples using Oracle’s Predictive Planning where planners can alter the time range of the historical periods to find the right starting point to reset the business.

These flexible tools also allow changes to the growth rates and updates to additional anomalies. The below screen shot of Oracle’s Predictive Planning also shows how easily you can move the growth rates visually before seeing the economic impact on your business.

Reconcile Unstable Economic Data

Most machine learning technology anticipates slight variations of data and will try to smooth that over. Unfortunately, the impact from COVID was more than a slight variation. Another option is to reconcile the inaccurate curves yielded from this is to completely ignore it. Consider removing 2020 from the 2-5 year trend altogether. For margin data, it is important to find the new starting point for the year before year over year growth trend is applied. Let’s assume a business saw consistent 5% growth year over year with the exception of 2020.

If a new starting point is applied to the beginning of 2021, it is reasonable to assume a similar growth rate assuming everything else. If a business has very seasonal data for revenue, costs and even expenses applying the same seasonal factors from previous years, excluding 2020 is probably a reasonable prediction as any. It’s important to remember that every industry and every business is different so there will always be exceptions to the rules and perhaps certain accounts that are still being impacted by these events and should be treated differently. Things like travel expenses and company meeting expenses should no longer use historical trends.

Bottoms-up Planning

For most businesses revenue and cost accounts are cyclical so using some seasonal or growth rate methodology makes a lot of sense. However, expenses are a different story. For many overhead and on-going expenses, it was very common to assume a run rate with moderate increases. With many offices sitting empty and at home expenses increasing, using traditional run rates no longer applies. This is the perfect time to revisit all expenses and ask teams to build their budgets and forecast from the bottom up. Start with a clean slate and plan for every dollar. It is a great leading practice for every organization to consider a bottoms or zero-based plan from time to time to apply scrutiny over on-going expenses.

With some simple resets, financial plans can get back on track in 2021. Using the options above businesses can begin reusing true methodologies for forecasting. As always, it is a good practice to have a few different versions of the forecast to be proactive instead of reactive and be ready for multiple economic outcomes. While no forecast is perfect, do not history define the future.

Looking to dive deeper into AI Forecasting or other Cloud EPM capabilities? Connect with [email protected] and get your Cloud EPM questions answered. To stay up to date on all things AI Forecasting and Cloud EPM, subscribe to Elire’s Monthly Cloud Newsletter. Follow Elire on LinkedIn and Twitter to receive industry updates no matter the time or place.

SME Author

-

Scott Costello

Mr. Costello is an experienced EPM specialist with over 20 years of experience helping organizations with their Close, Budgeting, Forecasting and Reporting needs. Certified in Oracle EPM solutions from on-premises Hyperion to the Cloud EPM suite, he has lead over 60 projects as an architect, project manager and consultant to provide clients with the best overall solution.

Author

-

Ms. Hutchcraft serves as Elire’s Marketing Associate, working to develop and optimize marketing brand assets. Jordan collaborates with the Elire Marketing Team to produce blog and social media content, strategize for social media expansion, and maintain Elire’s internal and external branding.