Account Reconciliation as part of your monthly, quarterly, and annual close can be tedious, time consuming and even confusing. And using solutions like spreadsheets can add even more problems with security, auditability, and simple mistakes. Technology can eliminate these problems, but the right processes must be in place. There are three goals that organizations should strive for to simplify and modernize their Account Reconciliations process – automated, accurate and actionable.

Automate

Every Account Reconciliation process that is built in spreadsheets involves the same process every month. Download or export a trial balance from the general ledger and then copy that trial balance into a workbook for references. This is a manual process, and when new accounts are added user must manually insert these new accounts into the workbooks. If there are last minute postings, the download and integration into the process must happen all over again. Oracle’s Account Reconciliation solution has direct integration into general ledgers so that when the data changes or new accounts are added, they can be fed directly into the tool.

Account Reconciliations tools should also eliminate the need to reconcile data that is off by a marginal amount. Spending time researching and reconciling accounts that are off by a few dollars is not time well spent. Oracle’s solution includes the ability to automatically reconcile data for specific accounts or as a holistic rule when the difference between the two sources too small to impact the business. These rules can be copied forward for future periods and notifications can be sent informing appropriate parties of the thresholds used.

Accurate

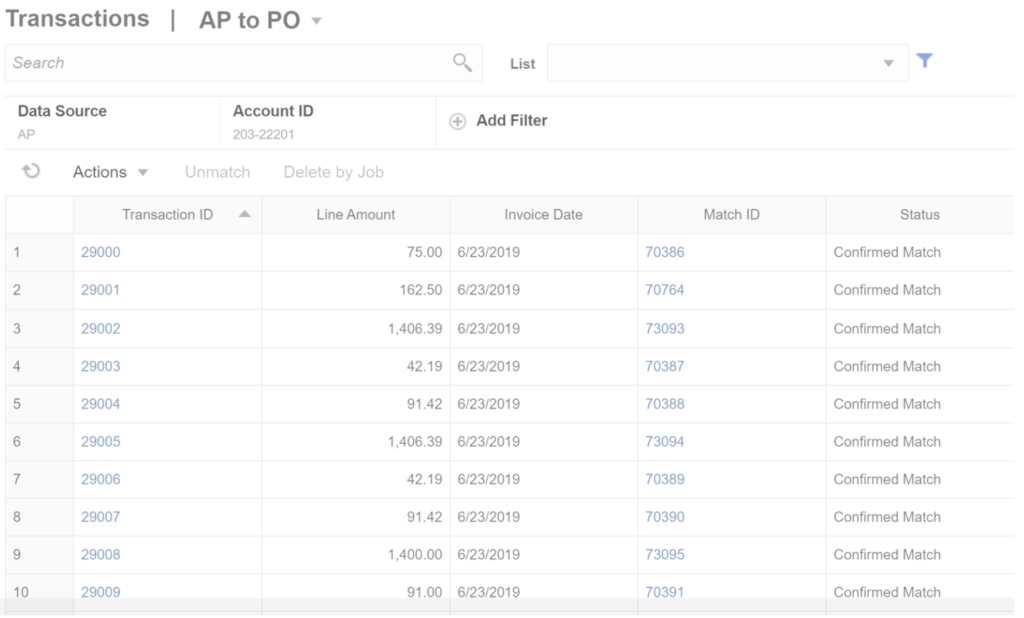

As each account is reviewed it is important to know what the account is used for and is the source to tie out against to accurately reconcile. Accurate reconciliations can lead to finding problems quickly and even help detect fraud when reconciling cash accounts. The best way to be as accurate as possible is to match each transaction from the source to the general ledger. For some organizations, this can mean hundreds or thousands of transactions for the month for just one account. With modern technology organizations can let the tools do the work. The right tools can comb through all the transactions of the source and the target, match where the data is consistent and pinpoint transactions that do not have a match. This can save hours of work and assure more accurate reconciliations. Below is a screenshot of Transaction Matching in Oracle Account Reconciliations, that matches every AP transaction in the General Ledger to every invoice in Accounts Payable.

Actionable

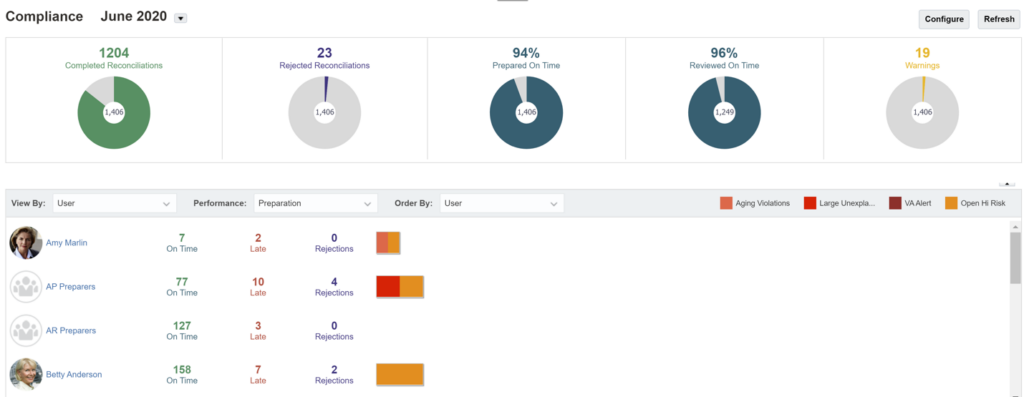

One of the biggest challenges with Account Reconciliations in spreadsheets is users may run their processes slightly differently. Without a standardized process, it can be difficult to yield consistent and reliable results. Oracle’s technology creates standardized process can be clearly defined for each account or group of accounts. When everyone knows the actions to take on every account, the reconciliation process becomes much easier. If processes are clearly defined for each user, users are monitored and held accountable for their actions throughout the process. Below is a screenshot of the Compliance Dashboard in Oracle Account Reconciliations displaying the status of each user’s stage in the process.

Once a company-wide process is defined, other action items can be simplified. For example, organizations can identify accounts with the highest risk of error and following specific statutory requirements. As actions are completed, tools such as Oracle’s Account Reconciliation can provide insights to monitor those actions, find bottlenecks, and speed up the overall process.

With any technology, standardizations of internal processes save time and money. Having the right technology can speed up reconciliations while ensuring consistency. An automated solution will drive accuracy making it simple to identify the accounts that need action.

To learn more about Oracle Account Reconciliation solutions, or Elire Cloud EPM services, please contact [email protected]! Looking for more tips and tricks to elevate your Cloud EPM application? Subscribe to Elire’s Monthly Cloud Newsletter for always fresh and always reliable Cloud knowledge. Follow Elire on LinkedIn and Twitter to receive industry updates directly to your phone.

Author

-

Mr. Costello serves as an Elire Partner, leading Elire's Close and Consolidations Practice. He is a CPA with over 25 years of experience implementing and advising on Hyperion/Oracle EPM. Scott started with Hyperion in 1999 and implemented first versions of Planning and Oracle Cloud EPM. He has helped hundreds of clients with their reporting, closing and budgeting needs.

View all posts