Oracle’s Tax Reporting Cloud (TRC) and Financial Consolidation and Close (FCCS) are critical modules designed to streamline business processes. As part of their cloud transformation journey, organizations often implement these modules either in phases or concurrently, depending on business criticality and strategic direction from leadership.

FCCS helps streamline accounting activities associated with end-of-month, quarter-end, and year-end financial close, delivering automated statutory IFRS/GAAP-compliant financial reports. The Tax Reporting Cloud solution simplifies tax processes, allowing tax teams to focus on analysis rather than data reconciliation. TRCS supports a wide variety of activities including tax provisioning, Country-by-Country Reporting (CbCR), reporting and tax data collection, audit tracking, and workflow approvals.

There are clear distinctions between FCCS and TRC in terms of domain, scope, and capabilities. However, these cloud applications do not exist in silos and have dependencies that must be factored in during implementation.

TRC is especially suitable for companies reporting under IFRS and US GAAP. It is the continuation of the on-premise Hyperion Tax Provision solution and enables easier collaboration across the organization, leading to a more efficient tax process.

Key Advantages of TRC

- Detailed Provisioning: TRC calculates the tax provision on an entity basis, consolidates it upward, and generates the necessary journal entries

- Automation: TRC includes advanced automation functionality that reduces errors and effort. Examples include automated handling of temporary and permanent differences and filing CbCR reports. Source data can be pulled directly from FCCS or other systems

- Workflow: The workflow engine enhances internal control over the data collection process and provides visibility into task status and ownership

- CbCR: An out-of-the-box Country-by-Country Reporting template is included, meeting OECD requirements and offering analytical tools

- Reporting: Built-in reports and dashboards support the analysis of tax data and the generation of tax disclosures

- Tax Sensitivity Analysis: Leverage advanced EPM analytics capabilities to perform sensitivity analyses, anticipate key trend changes, and model the impact of tax rate changes on financials

Oracle TRC provides a comprehensive solution for tax provision, including data integration, calculation, and estimation. TRC aids clients in meeting compliance requirements and accurately reporting tax liabilities.

Frequently, as part of a Global Transformation Program, Oracle Tax Reporting Cloud is used to support tax reporting requirements in the following areas:

- Actuals tax provisioning for group year-end accounts

- Budget and forecast tax provisioning for planning processes

- VAT return data collection and trend analysis through dashboards

- Country-by-Country Reporting (CbCR)

It is important to note that the above business processes and scenarios are not achievable via FCCS. This becomes a key motivating factor for implementing TRC after an FCCS deployment.

Oracle TRC and FCCS Alignment

Oracle’s TRC and FCCS need to be aligned for seamless integration, particularly in their chart of accounts structure. This alignment facilitates smooth data flow and empowers organizations to achieve robust tax reporting.

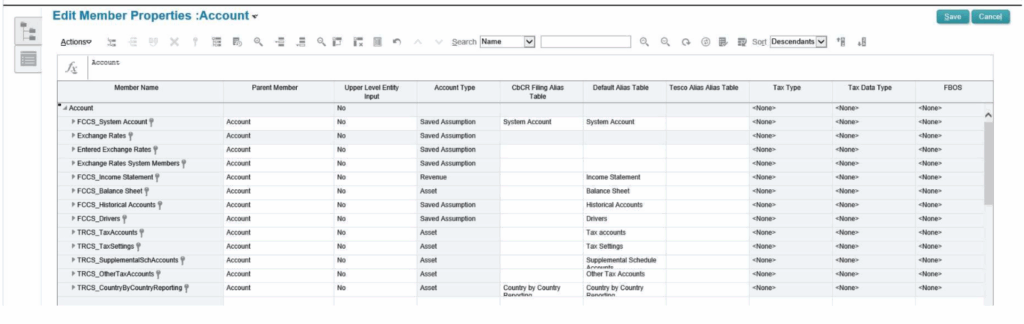

When TRC is deployed, Oracle automatically creates a set of foundational structures, most notably the “FCCS_Balance Sheet” and “FCCS_Income Statement” account dimensions.

These structures mirror the “FCCS_Account” dimension found within FCCS.

This metadata replication helps establish a consistent account structure and enables efficient data flow between FCCS (source) and TRC (target), reducing reconciliation needs and providing a clear audit trail.

While FCCS-derived structures provide the foundation, the key transformation happens within the “TRC_Tax Accounts” hierarchy. This is designed to capture and manage tax-related data via tax automation rules.

Tax Automation is a critical process that provides data for core tax calculations. It represents the link between Book data and Tax data. After loading trial balance data into the application, the Tax Automation process can be run to link tax-sensitive book data to one of the following tax accounts:

- Permanent Difference accounts

- Temporary Difference accounts

- Pre-Tax Income Adjustment accounts

- Additional Provisioning accounts

In a typical business scenario:

- FCCS is fed by trial balance data from the source ERP system

- FCCS consolidates financial data, populating the “FCCS_Balance” sheet and “FCCS_Income” statement accounts

- TRC, due to its mirrored structures, already has these accounts available in its account dimension

- Tax automation rules are configured to extract relevant data from the FCCS-derived accounts and populate the corresponding “TRC_Tax” accounts

- These rules then apply necessary tax calculations and adjustments, preparing the data for tax reporting

This streamlined, structured process ensures that tax reporting is based on accurate and consistent financial data, directly from the consolidated financial statements. Organizations should take advantage of this structured approach when implementing TRC post-FCCS to improve data accuracy and auditability.

If you are interested in learning more on implementation paths and options for TRC in your organization, please reach out to [email protected].

For more information on Elire’s EPM capabilities, check out our EPM services page or expert EPM blogs. Stay up to date on all things Oracle EPM by following us on LinkedIn and X.

Author

-

Munish Agnihotri is a Managing Consultant at Elire’s Global Services Hub, specializing in delivering Oracle Cloud solutions with a focus on strategic transformation.

View all posts Managing Consultant