Oracle is introducing two major enhancements for U.S. payroll customers that mark a significant shift in how taxes are calculated and managed within HCM Cloud – the launch of the US Oracle Payroll Tax Engine (USOPTE) and a new Enhanced Address Experience. Together, these features aim to improve payroll compliance, accuracy, and operational flexibility, while removing the longstanding reliance on third-party tools like Vertex.

Whether you’re already using Oracle Payroll or preparing for implementation, here’s what you need to know about these updates and how they’ll impact your setup.

Moving Away from Vertex: Oracle’s Native Tax Engine

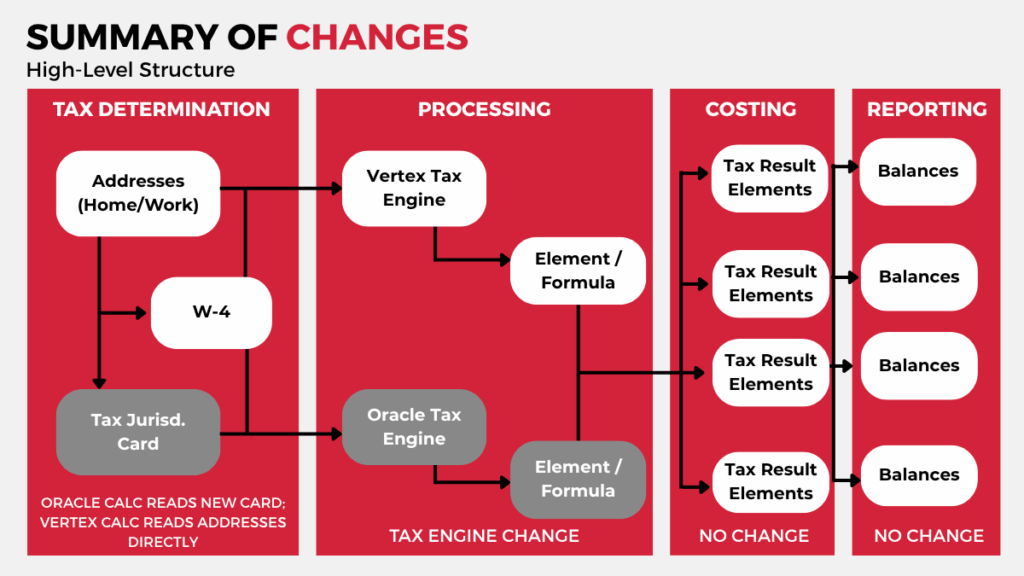

With the release of USOPTE, Oracle Payroll for the U.S. will now use Oracle’s own built-in tax engine to handle federal, state, and local tax calculations. Following the model successfully launched in Canada, this update will remove dependencies with Vertex, allowing Oracle to control updates, compliance, and support entirely in-house.

What’s staying the same? Most existing tax result elements and balances will remain intact, which means no major downstream changes to your costing, tax filing, or reporting processes. Ongoing statutory updates, previously sourced from Vertex, will now be delivered directly by Oracle on a monthly cadence, with zero downtime during production updates.

Key differences in the transition from Vertex to USOPTE

Precision Withholding Through Geospatial Intelligence

The Enhanced Address Experience introduces street-level address verification within HCM flows, using USPS-standard formatting and real-time validation. As users enter addresses, they’ll see predictive autocompletion and automatic ZIP+4 detection. But the real innovation is behind the scenes.

Oracle now captures latitude and longitude at rooftop accuracy, matching address data with internal geospatial map files to determine precise local tax jurisdictions—even in states with complicated local taxes like Ohio, Pennsylvania, and Kentucky.

This improvement directly powers the new USOPTE engine’s ability to automatically detect applicable tax jurisdictions based on work and home locations. It also ensures that even hard-to-catch jurisdictions (like special tax districts, school districts, or townships) are correctly assigned and calculated.

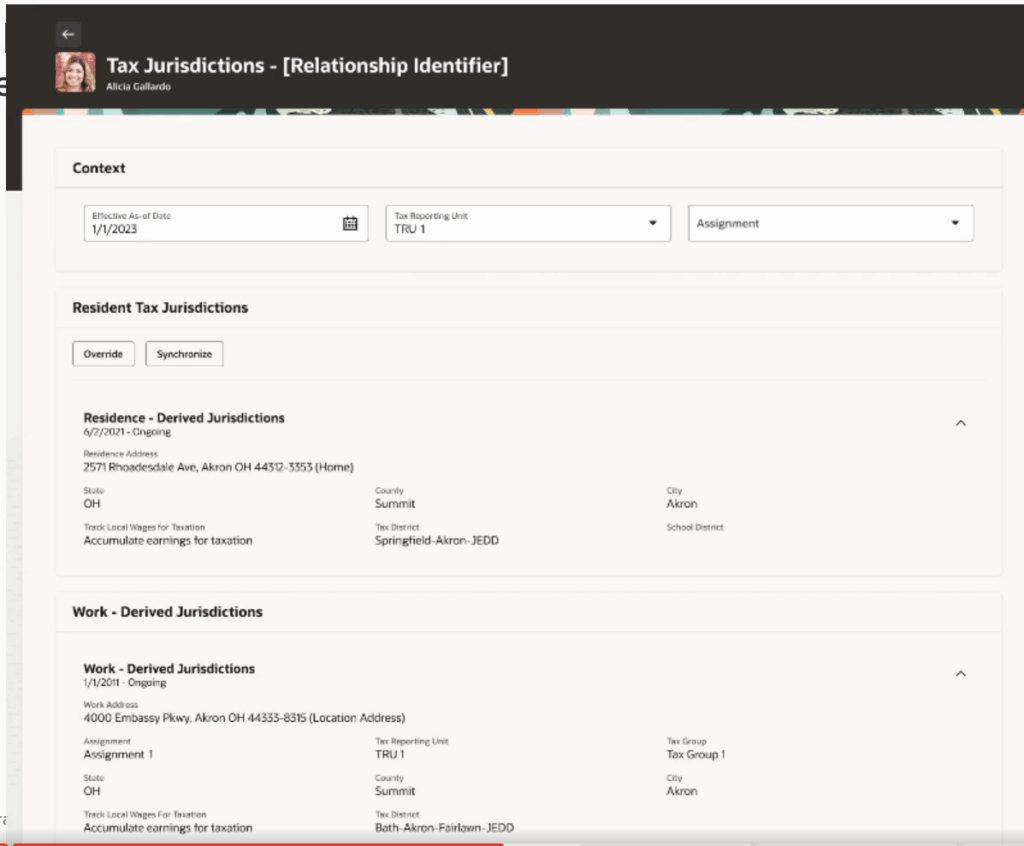

Oracle USOPTE Tax Jurisdiction Relationship Identifier

A New Way to View and Manage Tax Jurisdictions

As part of this rollout, Oracle has delivered a new Tax Jurisdictions calculation card, accessible via Redwood UI. This card clearly displays the detected residence and work jurisdictions for each employee, based on geospatial data. Payroll administrators can still apply manual overrides if necessary, but in most cases, this feature reduces the need for manual configuration.

The card integrates directly into the payroll flow and works alongside the new engine to ensure accuracy and compliance without user intervention.

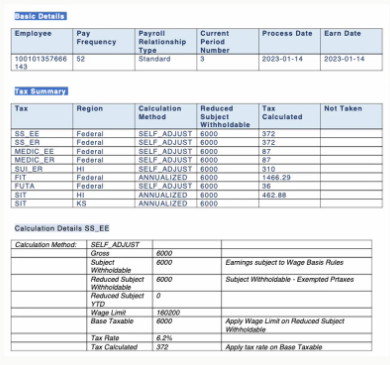

Tax Calculation Statement: Clearer Calculations, Easier Troubleshooting

For the first time, Oracle is offering a Tax Calculation Statement for US payroll.

This PDF-based output shows a line-by-line breakdown of how taxes are calculated for each employee – including inputs from W-4s, employer configuration, applicable tax rules, and the final math.

Oracle Tax Calculation Statement for US Payroll

This visibility helps payroll teams:

- Validate compliance

- Investigate pay disputes

- Compare calculations across test environments

- Understand updates and known variances between USOPTE and Vertex

A Redwood-based UI for the statement is in development, with the potential for employee self-service access in future releases.

Support for Additional and Supplemental Tax Scenarios

Oracle’s native engine also expands the range of supported tax scenarios, including:

- Colorado Employer Occupational Privilege Tax

- Hardin County, KY Industrial District Tax

- Northern Mariana Islands Territory Tax

The engine also supports cumulative supplemental taxation, including the Federal Lump-Sum Self-Adjust method. Instead of applying supplemental withholding on each individual payment, Oracle calculates the correct tax by looking at total year-to-date supplemental pay and subtracting previously withheld taxes – reducing the chance of over-withholding.

Testing and Transition Planning

To prepare for the transition, Oracle recommends testing in a non-production environment with a focus on:

- Validating tax calculation results with the Tax Calculation Statement

- Testing jurisdiction detection following address changes

- Running multiple supplemental payment scenarios

- Reviewing retroactive overpayment logic

Oracle has provided transition guides, known variance documentation, and additional videos to support your team as you prepare.

Transition Timeline: Required by Update 26A

Oracle has announced that all customers must transition to USOPTE by Update 26A to align with operational goals, including improved uptime, patching flexibility, and response times.

For organizations using Oracle Payroll, this is more than a feature update—it’s a strategic shift. With better visibility, real-time validation, and Oracle-native control over the entire tax process, these enhancements mark a major step forward in payroll modernization.

What’s Next?

Have questions about how these changes could impact your organization? Reach out to [email protected] to connect with our experts. To learn more about how Elire supports HCM clients, visit our Cloud services page. Stay informed by subscribing to our monthly Cloud newsletter and following Elire on LinkedIn and X for the latest updates, insights, and resources.

Author

-

Ms. Maxim serves as a Managing Consultant in Elire's Oracle Cloud HCM practice. Melanie brings to the table project management as well as payroll processing and payroll tax experience, leveraging her extensive analytical skills and leadership abilities so her clients see success.

View all posts