What is Working Capital, What Are Working Capital Ratios, and How to Leverage Working Capital for Better Decision-Making

Mastering Working Capital Management is crucial for driving success and maintaining financial health. Working capital, the difference between a company’s current assets and current liabilities, is more than just a measure of liquidity—it’s a powerful tool for informed decision-making. By effectively leveraging working capital, businesses can optimize cash flow, invest in growth opportunities, and navigate economic fluctuations with agility.

In this blog, we’ll explore strategic approaches to harness working capital and offer insights into how to make better decisions that propel your business forward, explore questions like what is working capital, what are working capital ratios, what is working capital management, and many more. Dive into working capital management below.

What is Working Capital?

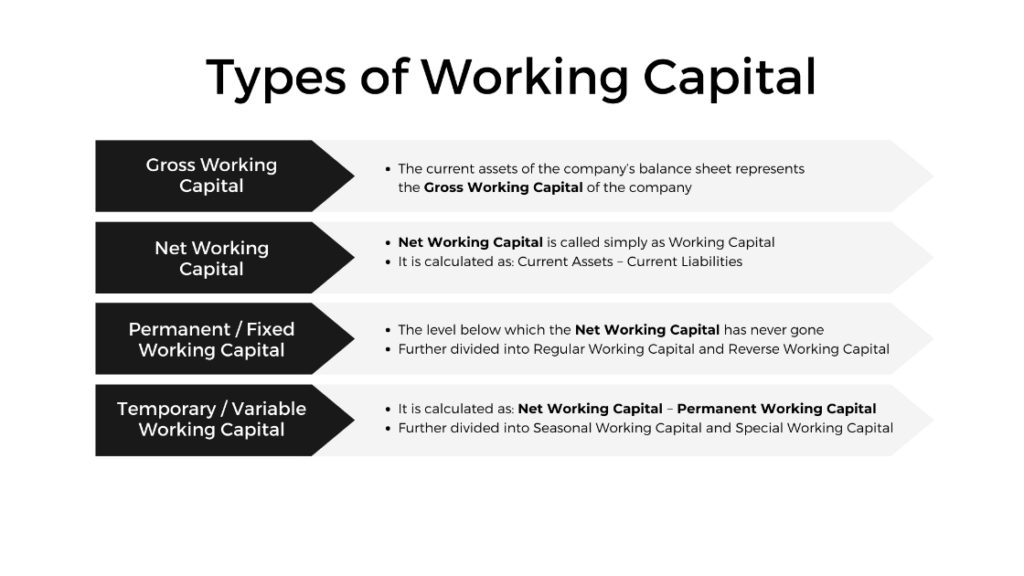

A company’s working capital is the capital an organization has left over after accounting for its current liabilities. Working Capital is critical as it is used to keep a business operating smoothly and ensures they are in a position to meet all current and short-term financial obligations within the coming year.

Working Capital Management

Working Capital Management involves overseeing and optimizing short-term assets and liabilities to ensure Companies maintain sufficient liquidity to meet their operational needs and financial obligations. It focuses on managing accounts receivable, inventory, and accounts payable to balance efficiency and liquidity.

Working Capital Management is crucial because it directly impacts a company’s cash flow, operational efficiency, and overall financial health. By optimizing these elements, organizations can improve their ability to finance day-to-day operations, invest in growth opportunities, and reduce the cost of capital. Without proper management, companies may face cash shortages, which can hinder their ability to sustain operations or seize new opportunities. Understanding and implementing robust Working Capital Management strategies is vital for sustaining business stability and fostering long-term success. Using tools such working capital ratios and paying attention to working capital cycles can positively impact an organization’s overall financial health and operations, providing greater efficiency. A treasury management system can track, manage, and calculate these ratios and cycles for better visibility into these crucial factors. For more on treasury management system vendors and the selection process, view our Treasury Services page here and download our informational one sheets.

What are Working Capital Ratios?

An effective Working Capital Management strategy works by ensures that a company operates efficiently by monitoring and using its current assets and liabilities to their most effective use. The efficiency of working capital management can be quantified using ratio analysis; the use of key performance ratios such as working capital ratio, inventory turnover ratio and the collection ratio.

Working capital ratios and analysis are essential for assessing a company’s liquidity. They help evaluate operational efficiency in managing inventory, receivables, and payables, identifying areas for improvement. Having strong ratios can boost investor confidence and creditworthiness, while highlighting financial risks and enhancing profitability through effective working capital management.

Working Capital Cycles

Working Capital Cycles represents the period measured in days from the time when the company pays for materials or inventory, to the time when it receives payments for the products or services that it sells. The formula for calculating Working Capital Cycles is below:

Working Capital Cycle in Days = Inventory Cycle + Receivable Cycle – Payable Cycle

Companies may rely on this cycle when it comes to proper working capital management and utilize something know as Cash Conversion Cycle, which is the minimum amount of time required to convert net current assets and liabilities into cash. Having a low cash conversion cycle (CCC) improves liquidity, reduces working capital needs, and enhances profitability by speeding up cash inflows from receivables and inventory turnover. It lowers reliance on external financing, reduces financial risk, and provides a competitive edge, while also signaling operational efficiency, boosting investor confidence, and allowing for better supplier and customer management. It ensures timely payment to suppliers, quick collection of receivables, and effective inventory management, reducing financial risk and improving overall cash flow stability.

Elire’s Expertise

At Elire, we leverage our expertise and proven methodologies to guide businesses toward success in their treasury operations. If you’re looking for tools to better leverage your organization’s working capital, Elire is here to help. Our Treasury Management System (TMS) road map services can help guide you toward a solution that best fits your organization. Having a TMS that can protect and project working capital can be very worthwhile and provide significant cost savings. Reach out to our team of experienced treasury consultants and see how Elire can assist your organization. Contact [email protected] and visit our Treasury Services Page for more.

Authors

-

Ms. Caron serves as Elire's Marketing Manager, specializing in content strategy and digital media communications. Maddie works to deliver relevant industry updates and technical blog posts to educate and engage Elire's audience.

View all posts -

Sandra Carter is a Senior Consultant at Elire with 20 Years of Corporate and Consulting Treasury Expertise. She is highly skilled in teaching and knowledge transfer of key treasury and TMS principles, and is a certified Kyriba Implementation specialist with expertise in Core Data, Deal Capture, Cash Management, and Forecasting.

View all posts