Building a Strong Foundation for Financial Close and Consolidation

For organizations of all sizes, the financial close and consolidation process is often time-intensive and resource-demanding. Oracle Cloud EPM’s Financial Consolidation and Close (FCCS) solution offers a purpose-built process that addresses these challenges by streamlining consolidation and reporting, ensuring transparency, accuracy, and compliance.

This blog provides an expert overview from Elire’s Ivan Casarrubias into the features, benefits, and customizability of Oracle EPM FCCS to support a comprehensive close process, all while allowing finance teams to shift focus toward analysis and decision-making.

A Complete Guide to Streamlined Reporting and Compliance

The modern business landscape demands precision and efficiency in financial reporting, but many organizations still struggle with manual, error-prone processes. FCCS is designed to alleviate these common pain points by delivering a fully automated consolidation and close solution that accelerates timelines and ensures consistency.

The Oracle Cloud EPM FCCS solution empowers users to automate consolidation tasks, allowing for seamless execution of orchestrated processes. This can be accomplished on a predefined schedule using EPM Automate scripts or performed on an ad-hoc basis by running Pipelines, providing teams with the flexibility to align their operations with varying reporting schedules and requirements.

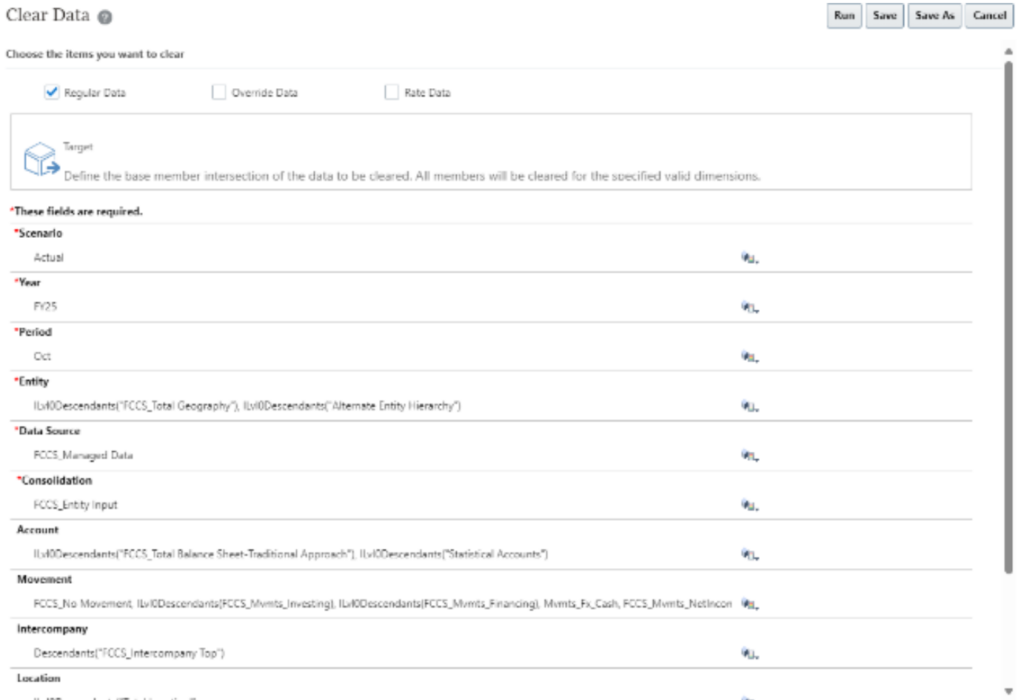

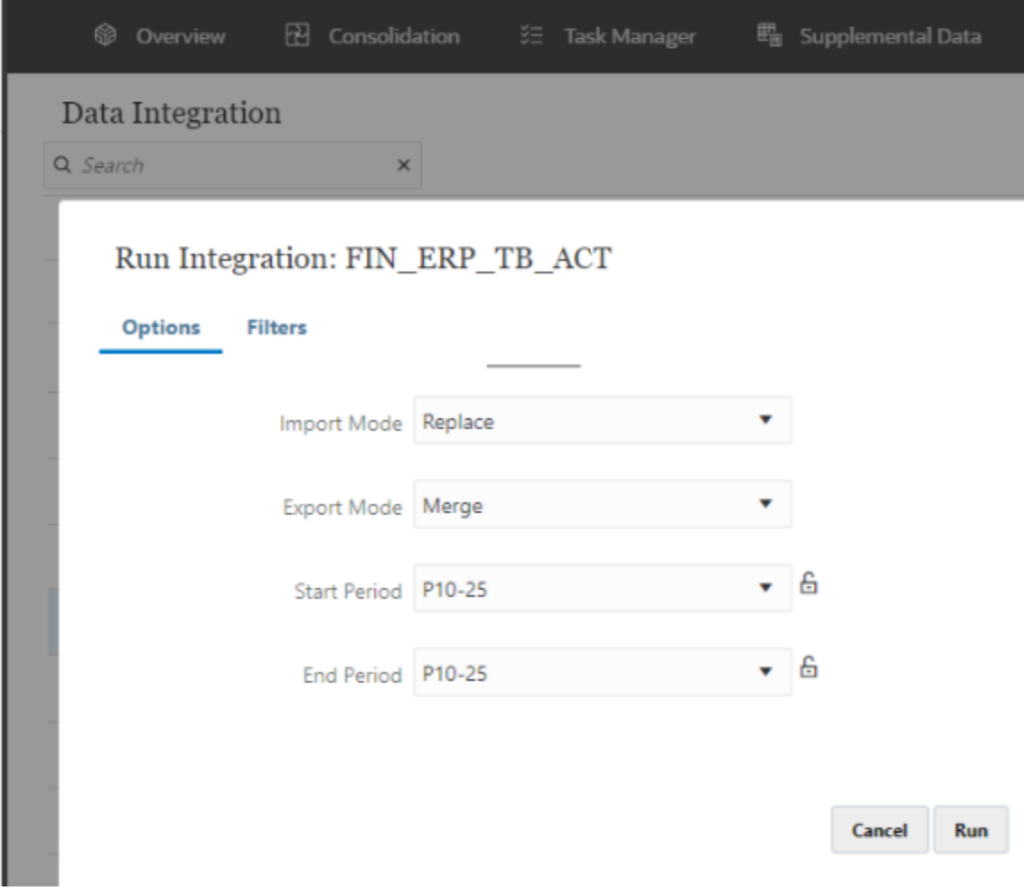

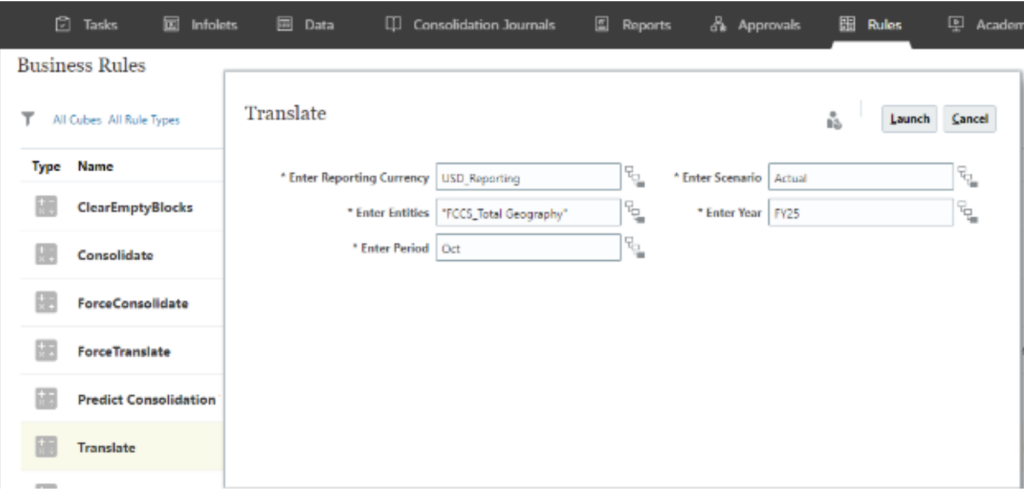

For instance, a typical sequence of automated EPM FCCS tasks might include:

- Clearing data for a specified Point of View (POV)

- Importing data for that POV

- Consolidating data for the POV

- Exporting data for Account Reconciliation

Sequence of automated FCCS tasks

These automations not only cut down on manual processes but also reduce the time and cost associated with each close cycle by using FCCS’s powerful multidimensional architecture and suite of out-of-the-box tools.

Tailoring Consolidation to Business Needs

Oracle Financial Close and Consolidation solution is highly adaptable, designed to meet the unique needs of various industries through best practices and customizable features. By offering pre-seeded content and flexible tools, FCCS allows organizations to create focused applications, eliminating unnecessary functionality and increasing system efficiency.

A major strength of FCCS is its capacity for personalization, which enables finance teams to develop specific calculation scripts and tailored business rules, such as translation and consolidation rules. Approval processes can be modified to align with unique team workflows, facilitating a structured and streamlined close process. For instance, some organizations have set up configurable dashboards and customized reporting views in FCCS to support real-time insights and decision-making, tailoring financial reviews to meet operational and strategic needs effectively.

Additionally, FCCS’s flexible integration options allow companies to work seamlessly across multiple systems. For example, a business may currently use a Microsoft product for source system data and Blackline for reconciliations, with plans to eventually transition to Oracle Fusion Cloud Financials and Oracle Account Reconciliation Cloud (ARCS).

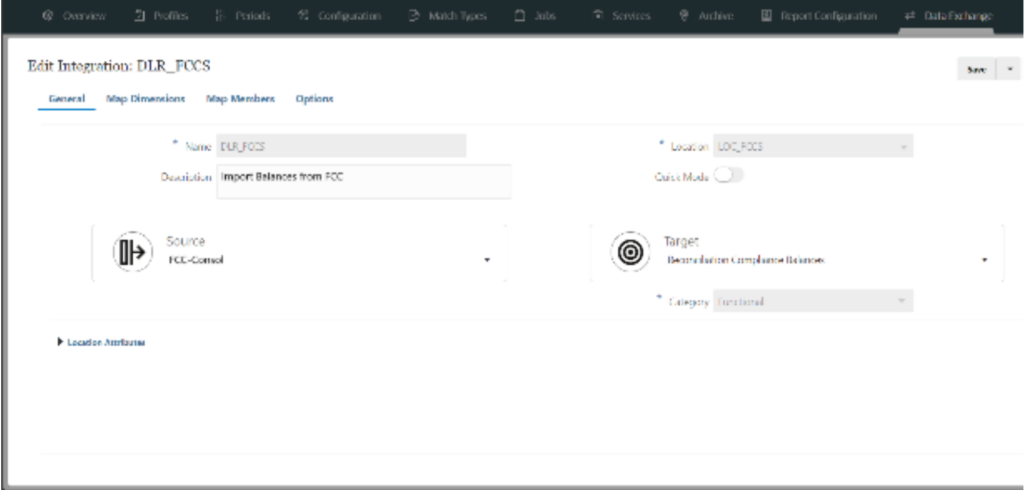

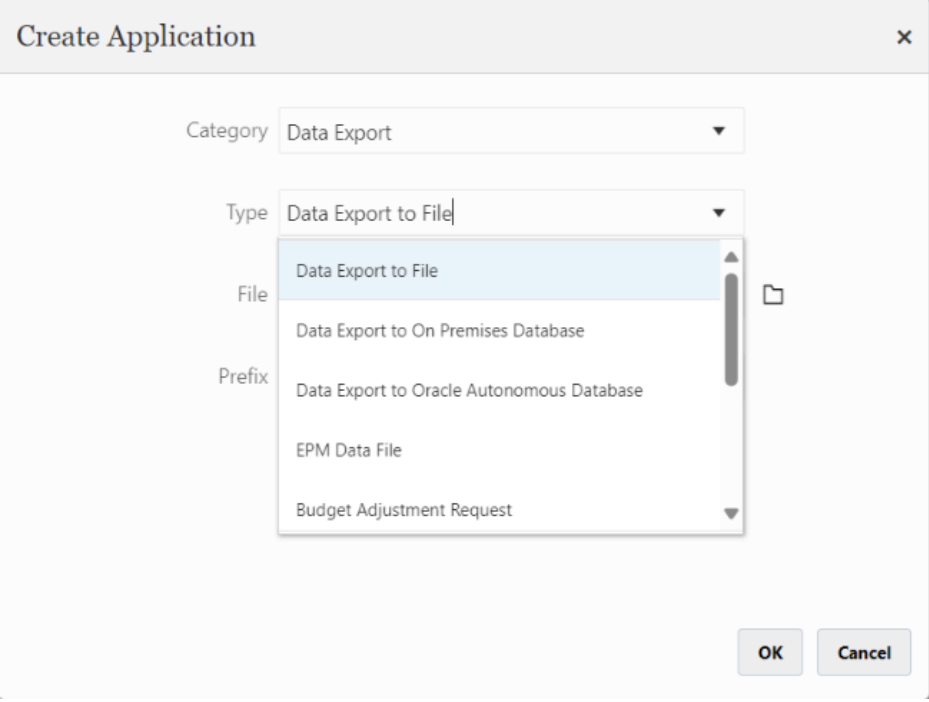

FCCS is equipped to integrate with both Oracle ERP Cloud and ARCS, while also maintaining compatibility with current applications. By leveraging the EPM Integration Agent, companies can import data from a Microsoft SQL database into FCCS. Data Exchange can also be configured to export data from FCCS in a format compatible with Blackline, enabling smooth data flow across platforms.

These customization options not only support FCCS’s integration with diverse applications but also facilitate future transitions without disrupting existing workflows.

Customizable data integrations in FCCS in terms of tailoring to specific business needs (3rd party applications)

Best Practices and Prebuilt Functionality

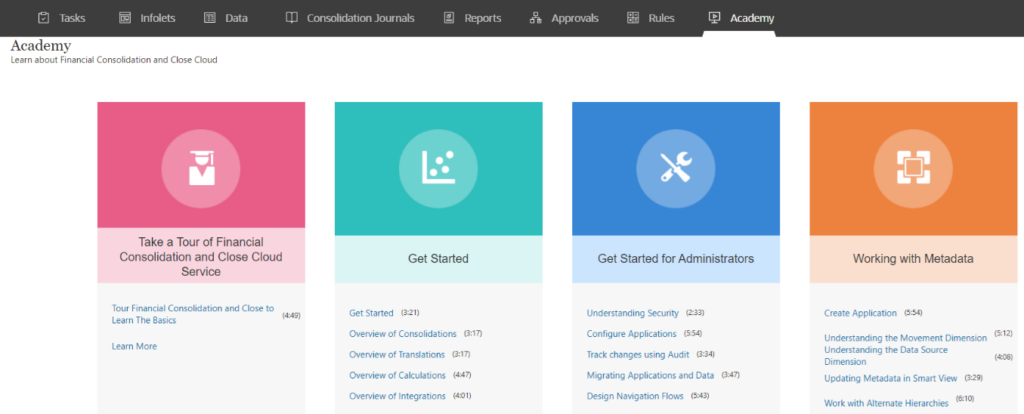

FCCS offers a framework, based on industry best practices, that is immediately operational – allowing organizations to get up and running quickly. The configurable framework provides ease of use, maintenance, and an upgrade path for future releases from Oracle. Built-in financial intelligence, including pre-built dimensions, reports, and dashboards, maximizes the solution’s value across the system’s lifespan.

The timeline for going live with FCCS can vary based on individual project specifics, generally taking between three to six months. Factors influencing this timeline include the availability of resources such as Enterprise Systems/IT, budget considerations, and personnel – specifically delivery teams, client-side accounting teams, and any third-party ERP administrators.

Oracle Academy FCCS demos and tutorials

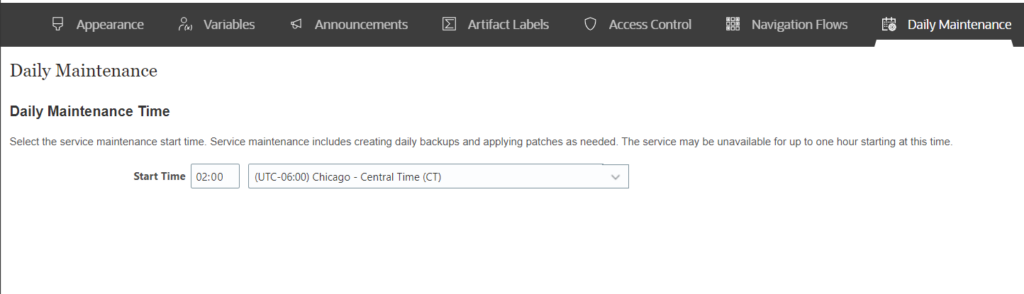

Oracle performs daily maintenance on all EPM Cloud applications by default, which includes creating daily backups and applying necessary patches. Major feature updates are typically released on the first Friday of each month, with updates applied to the test environment during the following daily maintenance window. Production environments are usually updated on the third Friday of the month.

As FCCS is part of the Oracle EPM suite, which offers the application as a service, customers benefit from continuous support and software updates. This approach ensures that organizations can easily adapt to changing business requirements while maintaining access to the latest features and enhancements, optimizing their financial consolidation and reporting processes over time.

Cloud EPM FCCS Daily Maintenance

What’s Next

Oracle EPM’s Financial Close and Consolidation software is a vital tool for organizations seeking to enhance their financial reporting and compliance processes. With its powerful automation capabilities, customizable features, and upgradeable framework, FCCS can streamline your consolidation and close process.

By leveraging best practices and prebuilt functionalities, organizations can quickly implement FCCS, ensuring a seamless transition to a more efficient financial operation. As businesses continue to navigate an increasingly complex financial landscape, investing in a solution like FCCS can drive greater transparency, accuracy, and adaptability, ultimately leading to improved performance and a competitive advantage.

There’s more FCCS information where that came from! Keep an eye out for Part 2 of Elire’s Cloud EPM Financial Close & Consolidation blog – where we dig into Enhanced Task Management for Close Processes, FCCS Integration with Hybrid Cloud Deployments, and Audit-Ready Reporting. Whether integrating with current financial systems or utilizing features like automated workflows and tailored reporting, Oracle Financial Consolidation and Close empowers organizations to enhance efficiency and ensure compliance.

Elevate your consolidation and reporting processes today! Register for the Elire Expert “Enhancing Close and Consolidations: Features of Supplemental Data Manager in FCCS” webinar on December 12th at 2:00 PM CT – featuring Senior Consultant Steven Wang.

Reach out to [email protected] with questions or to begin your EPM FCCS journey today. Ready to unlock the full potential of Cloud EPM? Elire offers diverse Path to Cloud solutions customized for your organization’s unique needs. Explore more on Elire’s EPM & Analytics Services Page for implementing Oracle Cloud EPM. Keep your finger on the pulse of Oracle Cloud developments by signing up for Elire’s Monthly Cloud Newsletter! For real-time updates, follow Elire on LinkedIn and Twitter.

Authors

-

Mr. Casarrubias is an Elire Consultant, specializing in Oracle Cloud Enterprise Performance Management. Ivan is passionate about Business Intelligence and EPM technology. Partnering with clients to help achieve their EPM goals, Ivan assists in streamlining organization's financial business processes.

View all posts -

Mrs. Selness serves as Elire’s Marketing Specialist, working to develop and optimize marketing brand assets. Jordan collaborates with the Elire Team to produce blog and social media content, strategize for social media expansion, and maintain Elire’s internal and external branding.

View all posts